In the aftermath of the financial crisis of 2008, the image of Wall Street’s most influential powerbrokers being called before Congress to give an accounting of their actions will not soon be forgotten. One name was repeatedly invoked during this time, a reminder of when the government first had to step in to protect the American people from Wall Street’s excessive greed: Ferdinand Pecora.

In the aftermath of the financial crisis of 2008, the image of Wall Street’s most influential powerbrokers being called before Congress to give an accounting of their actions will not soon be forgotten. One name was repeatedly invoked during this time, a reminder of when the government first had to step in to protect the American people from Wall Street’s excessive greed: Ferdinand Pecora.

In the winter of 1933, Ferdinand Pecora took the reins of the bumbling Senate investigation of the 1929 crash. He was an unlikely hero: Sicilian-born, stout, with little experience in the Wall Street realm, he nevertheless created the sensational headlines needed to galvanize public opinion for reform. The hearings, under his leadership, spurred Congress to take unprecedented steps to rein in the free-wheeling banking industry, and led directly to the New Deal’s landmark economic reforms.

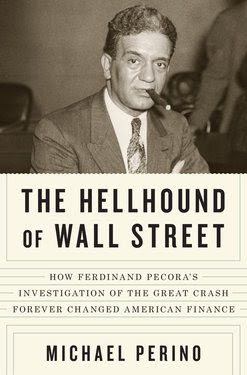

Now, Michael Perino’s The Hellhound Of Wall Street: How Ferdinand Pecora’s Investigation of the Great Crash Forever Changed American Finance, tells the story of Pecora’s pursuit of the “banksters” of Wall Street. The story a resonates so powerfully even today that Nancy Pelosi, Frank Rich, and Ron Chernow, among others, have publically referred to his legacy.

The Pecora commission brought an end to Washington’s traditionally hands-off approach to the stock market and led directly to the creation of the SEC and other landmark financial reforms that still govern our markets today.

In Hellhound Of Wall Street, Congressional hearings become high-stakes courtroom drama, with an inspiring tale of an unlikely hero’s triumph over powerful interests. Michael Perino provides a minute-by-minute account of the ten dramatic days when Pecora turned the hearings around, cross-examining the officers of National City Bank (today’s Citigroup), particularly its chairman, Charles Mitchell, one of the best known bankers of his day.

Mitchell strode into the hearing room in obvious disdain for the proceedings, but he left utterly disgraced. Pecora’s rigorous questioning revealed that City Bank was guilty of shocking financial abuses, from selling worthless bonds to manipulating its stock price. Most offensive of all, and all too familiar sounding today, was the excessive compensation and bonuses awarded to its executives for peddling shoddy securities to the American public.

A gripping courtroom drama with remarkable contemporary relevance, Hellhound Of Wall Street brings to life a crucial turning point in American financial history and reminds us again of the delicate and crucial relationship between Wall Street and government.

Michael Perino is the Dean George W. Matheson Professor of Law at St. John’s University School of Law. A former Wall Street litigator, Perino has authored numerous articles on securities regulation, securities fraud, and class action litigation. He has testified in both the United States Senate and the House of Representatives and is frequently quoted in the media on securities and corporate matters. He has appeared on NPR’s “All Things Considered”, “Morning Edition”, and “Marketplace”, and on “Bill Moyers’ Journal” on PBS, and on CNBC.

Note: Books noticed on this site have been provided by the publishers. Purchases made through this Amazon link help support this site.